Elijah Rofkoff/iStock via Getty Images

introduction

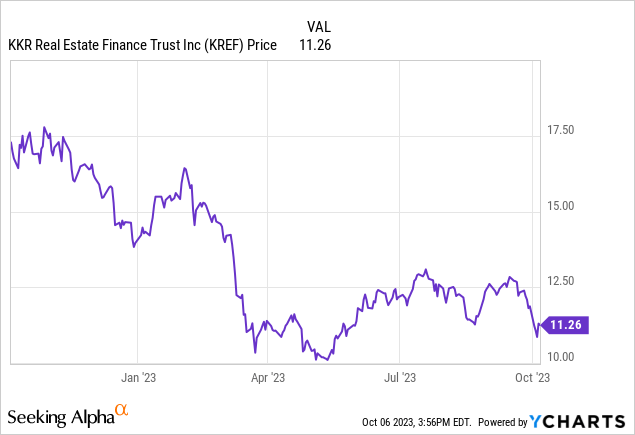

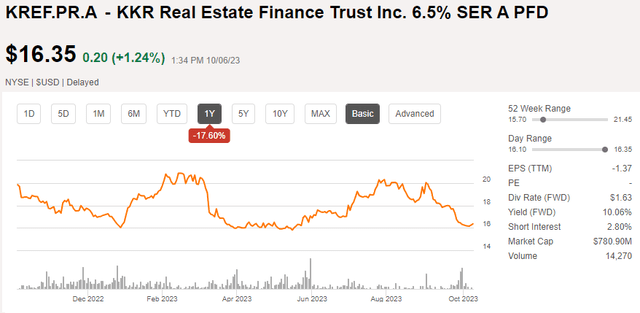

KKR Real Estate Finance Trust (New York Stock Exchange:KREF) We originate and invest in transitional senior loans backed by real estate. I wasn’t really interested in his REIT’s common stock, but I was interested in: It is the only company that issues preferred stock (NYSE:KREF.PR.A) as the ticker symbol. Despite my focus on these preferred stocks, I don’t have a long position yet as I wait to see how the REIT deals with rising interest rates in the financial markets. On the other hand, the stock price of preferred stocks continues to decline, and the yield on preferred stocks now exceeds 10%.

Checking the financial health of REITs

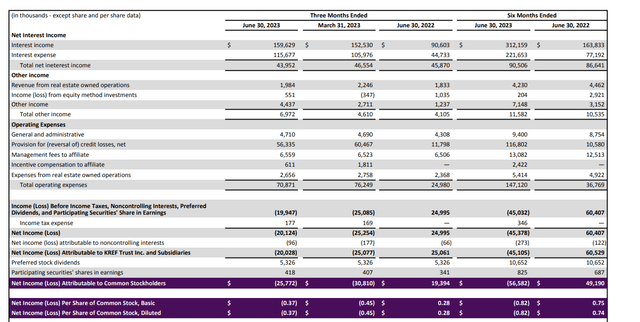

Looking at its reported net income, KKR Real Estate Finance Trust is riding out a volatile situation. The company is in the red this year. While net interest income for the second quarter was still pretty decent at $44 million, the REIT had more than $56 million in loan loss reserves after already allocating $60.5 million in loan loss reserves in the first quarter of this year. had to be accounted for.

KREF Investor Information

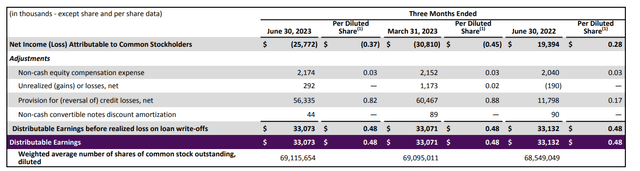

But of course, if you look at distributable earnings, it’s actually still a pretty solid return. As you can see below, total distributable income for the second quarter was $33.07 million, which is about the same as the first quarter of this year. This means distributable earnings per diluted share were $0.48.

KREF Investor Information

While this is encouraging and means the current quarterly payment of $0.43 is fully covered, the book value per share could certainly be eroded. With him holding just $0.05 per share each quarter, the REIT will hold just over $3 million of his capital. No problem under normal circumstances. But “saving” $3 million won’t do much to protect your balance sheet if your allowance for loan losses has consistently exceeded $50 million quarter after quarter for the past several quarters.

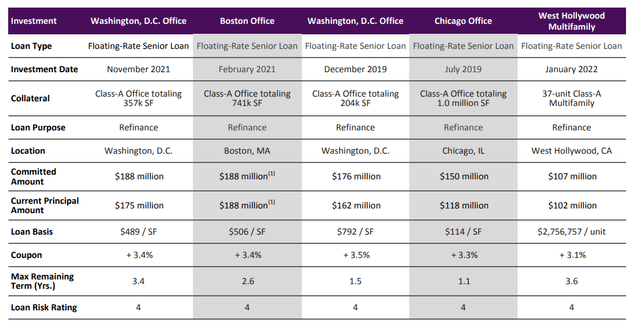

That being said, I like touching on apartment complexes. One of those assets, located in West Hollywood, California, currently has a risk rating of 4 by KREF. However, looking at a detailed overview of the portfolio, the $102 million loan was backed by approximately $155 million in collateral, based on a 65% LTV ratio at the time the loan was issued.

KREF Investor Information

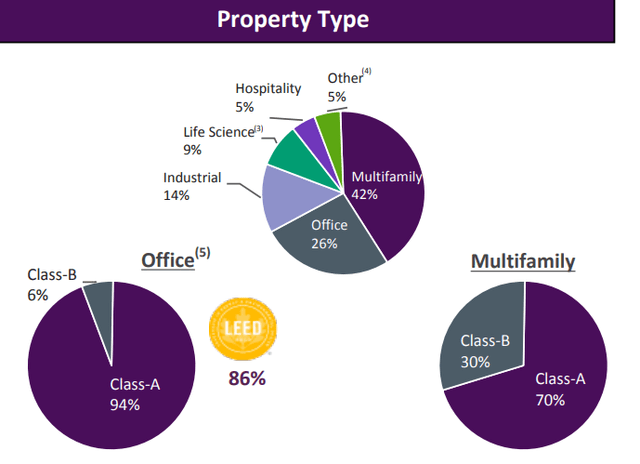

Of course, real estate values are down due to increased capitalization rates, but I’d like to think that multifamily properties are easier to market, remarket, and refinance than avoid haircuts for office portfolios.

KREF Investor Information

Preferred Stock: Preferred dividends remain covered

KR Real Estate Finance Trust has only one series of preferred shares available, which were issued in April 2021. The company issues cumulative preferred stock at a regular price of $25 and a preferred dividend yield of 6.5%, which means these securities are paying. Preferred dividend of $1.625 per year. The preferred dividend will be paid in four quarterly installments of $0.40625, and the preferred dividend yield will remain unchanged as long as these securities remain outstanding.

In search of alpha

The preferred stock may be called by KKR Real Estate Finance Trust from April 2026 onwards, but given current financial market conditions and the cost of capital, we do not expect KKR to call the preferred stock. not. A yield to call perspective is helpful here.

The preferred stock is currently trading at $16.35, giving it a yield of 9.95%. This is very attractive, but of course you want to make sure your asset coverage ratio and preferred dividend coverage ratio are high enough.

Let’s start with the desired dividend coverage level. We know that the REIT was in the red due to loan loss reserves, but we also know that the distributable income was just over $33 million. These distributable earnings already include $5.3 million in quarterly preferred dividends, and the REIT requires less than 15% of distributable earnings (before dividends) to cover the preferred dividends, so the preferred dividends are It means you are enjoying good coverage. So, based on that metric, preferred stocks are definitely interesting.

The main issue I currently have with KKR Real Estate Finance Trust is the asset coverage ratio. Having to deal with loan loss reserves is just part of doing business. However, a significant amount of the revenue is not retained, resulting in significant losses. In the first half of this year, the REIT had to allocate $117 million to loan loss reserves, but only received about $7 million in retained earnings.

As shown below, total equity on the balance sheet decreased by approximately $112 million. Meanwhile, KKR paid $59 million in dividends on its common stock. This means that by suspending dividends and retaining all distributable earnings, the REIT could have reduced the impact on its book value by 50%.

Of course, suspending dividends is not a common action and is often seen as a last resort. KREF may try to offer stock dividends while making stock options as attractive as possible to reduce erosion.

As you can see below, the total equity value on the balance sheet has decreased to $1.46 billion, and total common capital less $328 million in preferred capital is $1.13 billion, or per share. It came to $15.07. This is already well below the $16.56 per share at the end of last year.

Fortunately for preferred shareholders, common shareholders are the first to absorb those losses, so they are hit the hardest. At the end of the second quarter, we had approximately $1.13 billion of common stock, which is subordinate to our preferred stock. But at the rate of losses of $100 million per semester (admittedly, these are just loan loss reserves, and reserves can be written off), that cushion is dwindling fairly quickly. I am. Fortunately, the overall portfolio size has also decreased thanks to some repayments, and KREF is clearly actively managing its loan portfolio.

investment thesis

The conclusion is very simple. I’m not interested in common stock as long as loan loss reserves are this high. I would rather reduce dividends and use the proceeds to stabilize the balance sheet. Some investors point to superior distributable returns and the positive correlation between interest rates and that return, but if it’s eroding the equity on your balance sheet, that’s moot. There isn’t. Yes, returns are increasing, but on the other side of the equation, the value of the loan is decreasing faster than it is generating dividend income.

Preferred stocks, which currently yield nearly 10%, are certainly safer, but they are still speculative. A reduction in common stock dividends would be an absolute positive for preferred stocks, as it would stop or at least slow the erosion of balance sheet capital. Additionally, preferred shareholders may actually benefit from lower interest rates. Preferred stockholders are not affected by lower returns on common stock, but as borrowers are less likely to default and yields fall, preferred stock prices rise.

Simply put, I avoid common stocks. I currently have no position in preferred stocks, but they are definitely the only securities I would consider (from a speculative perspective).